Medicare Additional Premium 2024 Income Brackets

Medicare Additional Premium 2024 Income Brackets. Equal to or below $103,000: If your income has gone down.

The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible. If your income has gone down.

Equal To Or Below $103,000:

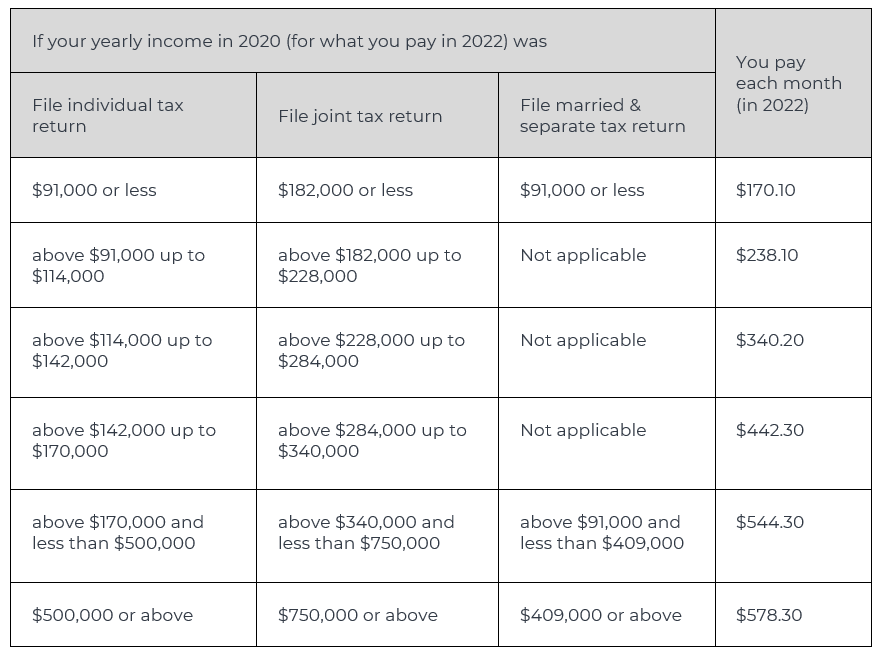

The standard monthly premium for medicare part b enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022.

In This Guide, We Break Down The Costs Of.

Yes, your income can affect the premium for medicare part b in 2024.

Married People Filing Jointly That.

Images References :

Source: devondrawletty.pages.dev

Source: devondrawletty.pages.dev

How Much Are Medicare Premiums In 2024 Lotti Rhianon, If you disagree with our decision. If you disagree with our decision.

Source: gayleqannetta.pages.dev

Source: gayleqannetta.pages.dev

Medicare High Tax 2024 Lily Shelbi, The percentage change in the 2023 to 2024 medicare part d irmaa payments is shown below. If you are expected to pay irmaa, ssa will notify you that you have a higher part.

Source: traceewdahlia.pages.dev

Source: traceewdahlia.pages.dev

Medicare Premiums For High Earners 2024 Terra, In 2024, the standard part b monthly premium is $174.70. If your income has gone above certain thresholds, you may pay a higher premium for.

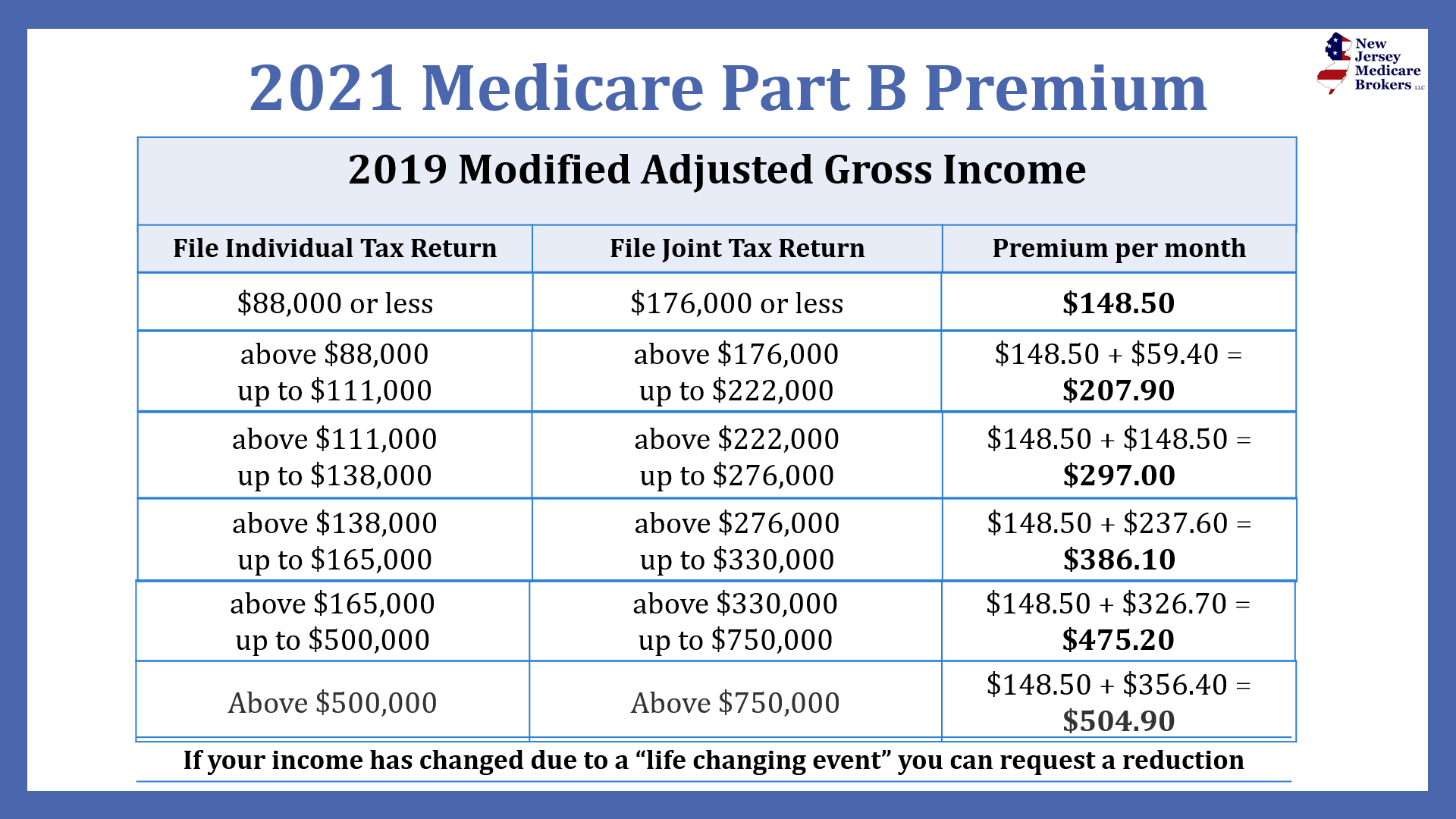

Source: www.njseniorins.com

Source: www.njseniorins.com

Understanding Medicare and IRMAA Related Monthly Adjustment, Your additional premium is a percentage of the national base beneficiary premium $34.70 in 2024. Monthly medicare premiums for 2024.

Source: www.senior-advisors.com

Source: www.senior-advisors.com

Medicare Blog Moorestown, Cranford NJ, This means that your medicare part b and part d premiums in 2024 may be based on your reported income in 2022. In 2023, individuals who earned more than $97,000 annually will have higher monthly premiums for some of their medicare coverage.

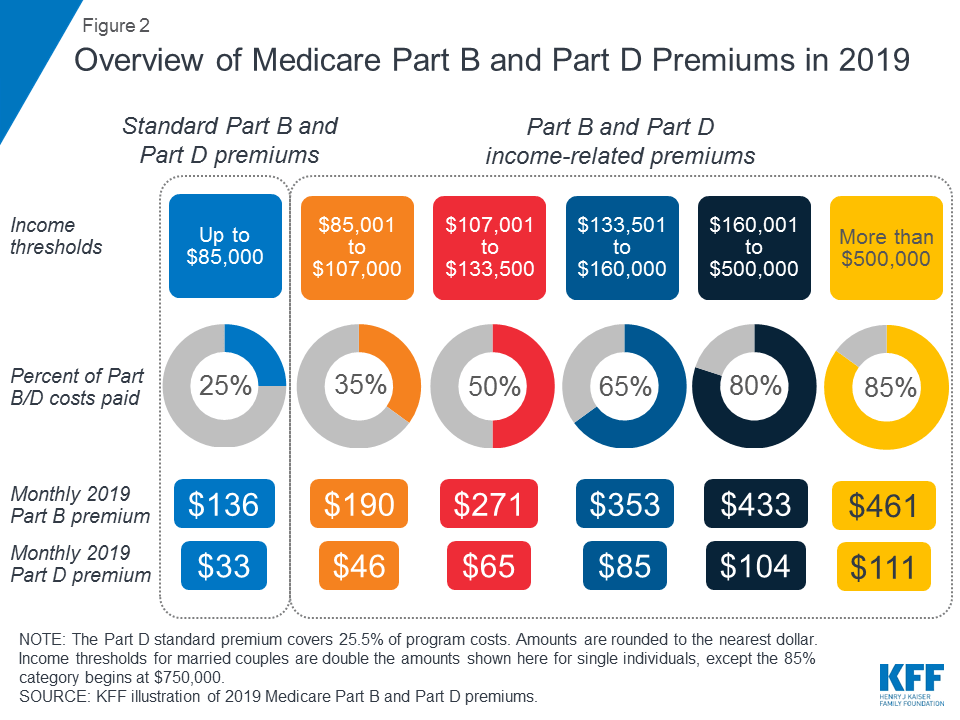

Source: www.kff.org

Source: www.kff.org

Medicare's Premiums A Data Note KFF, If your income has gone down. Your monthly premium in 2024:

Source: www.calpronetwork.com

Source: www.calpronetwork.com

Medicare Premium Limits — CALPRO, Medicare recipients with 2022 incomes exceeding $103,000 (single filers) or $206,000 (married filing jointly) will pay a. Income bracket adjustments for 2024 medicare part d irmaa.

Source: cielqcharmian.pages.dev

Source: cielqcharmian.pages.dev

Medicare Costs 2024 Chart Timmy Giuditta, Income bracket adjustments for 2024 medicare part d irmaa. For 2024, beneficiaries whose 2022 income exceeded $103,000 (individual return) or $206,000 (joint return) will pay a total premium amount ranging from $244.60.

Source: www.kff.org

Source: www.kff.org

Medicare’s Premiums Under Current Law and Changes for, The amount you’ll pay for your medicare premiums in 2024 hinges on your modified adjusted gross income (magi). Married people filing jointly that.

Source: bobbybrockinsurance.com

Source: bobbybrockinsurance.com

Your Guide to 2024 Medicare Part A and Part B BBI, The law requires an adjustment to your. The standard monthly premium for medicare part b enrollees will be $164.90 for 2023, a decrease of $5.20 from $170.10 in 2022.

The Law Requires An Adjustment To Your.

An official website of the united states government.

If You Are Expected To Pay Irmaa, Ssa Will Notify You That You Have A Higher Part.

The annual deductible for all medicare part b beneficiaries will be $240 in 2024, an increase of $14 from the annual deductible.