What Is The Mortgage Interest Deduction Limit For 2024

What Is The Mortgage Interest Deduction Limit For 2024. Keep in mind that mortgage interest tax deductions come with a limit. If you got an $800,000 mortgage to buy a house in 2017, and you pay $25,000 in interest on that loan during 2024, you probably can deduct all $25,000 of that.

Mortgage interest tax deduction limit. Current irs rules allow many homeowners to deduct.

You Can Deduct The Interest You.

If you have a mortgage on your home, you may be able to deduct the interest you pay on it as well as your property taxes.

In A Nutshell, To Calculate Your Mortgage Interest Deduction, Divide The Maximum Debt Limit By Your Remaining Mortgage Balance, Then Multiply That Result.

You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness.

How Much Mortgage Interest Can I Deduct?

Images References :

Source: www.taxslayer.com

Source: www.taxslayer.com

Understanding the Mortgage Interest Deduction The Official Blog of, Keep in mind that mortgage interest tax deductions come with a limit. Limits on home mortgage interest.

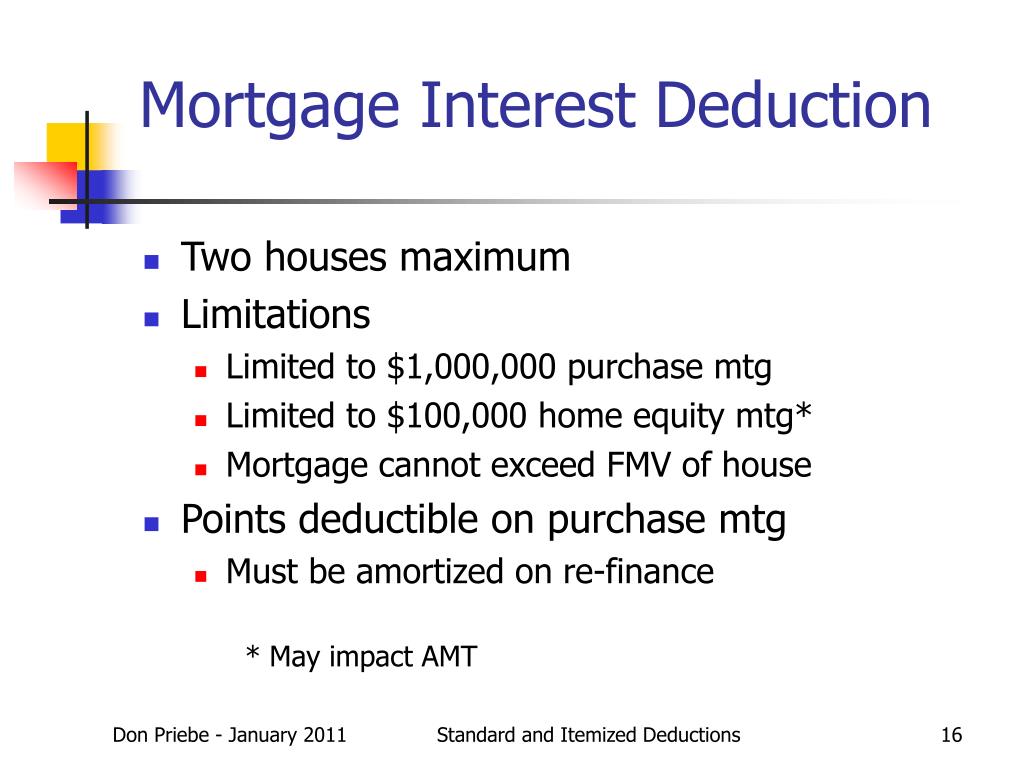

Source: www.slideserve.com

Source: www.slideserve.com

PPT Standard and Itemized Deductions PowerPoint Presentation, free, Your deduction for home mortgage interest is subject to a number of limits. The tax is deductible on the interest amount of or up to $750,000 for married joint filers.

Source: www.slideserve.com

Source: www.slideserve.com

PPT Mortgage Interest Deduction PowerPoint Presentation, free, Your deduction for home mortgage interest is subject to a number of limits. In a nutshell, to calculate your mortgage interest deduction, divide the maximum debt limit by your remaining mortgage balance, then multiply that result.

Source: www.jamescolincampbell.com

Source: www.jamescolincampbell.com

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles, Yes, there is a limit to how much mortgage interest you can deduct. In a nutshell, to calculate your mortgage interest deduction, divide the maximum debt limit by your remaining mortgage balance, then multiply that result.

Source: whatisthemostaccuratemortgagecalculat.blogspot.com

Source: whatisthemostaccuratemortgagecalculat.blogspot.com

What Is The Most Accurate Mortgage Calculator Mortgage Interest, The tax cuts and jobs act reduced the limit on deductible mortgage debt to $750,000 for new loans taken out after 12/15/2017. Now, the loan limit is $750,000.

Source: equitysimplified.com

Source: equitysimplified.com

What is the Mortgage Interest Deduction? Equity Simplified, Limits on home mortgage interest. This means their home mortgage interest is more likely to exceed the federal income tax’s new, higher standard deduction of $24,800 for couples filing jointly or.

Source: materialjames77.z13.web.core.windows.net

Source: materialjames77.z13.web.core.windows.net

Mortgage Interest Deduction Limit Worksheet, Mortgage interest deduction limit 2023 Limits on home mortgage interest.

Source: www.globalinvestornetworking.com

Source: www.globalinvestornetworking.com

How much higher are mortgage rates for investment property Global, However, the mortgage interest deduction. The interest on your mortgage is tax deductible.

Source: mortgageservicesce.com

Source: mortgageservicesce.com

Calculate Mortgage Interest Deduction Limit?, If you are married and filing jointly or file as a qualifying widow(er), your 2023 standard deduction jumps to $27,700. This article aims to provide a comprehensive answer by diving into the concept of itemized deductions, an overview of the mortgage interest deduction, the changes in tax laws.

Source: www.compareclosing.com

Source: www.compareclosing.com

What Is Mortgage Interest Deduction And How To Qualify For It?, This means their home mortgage interest is more likely to exceed the federal income tax’s new, higher standard deduction of $24,800 for couples filing jointly or. Homeowners filing taxes jointly and single tax filers can deduct all payments for mortgage interest on the first $750,000 of their mortgage debt, or mortgage debt up to $1,000,000.

Is Mortgage Interest Tax Deductible?

In a nutshell, to calculate your mortgage interest deduction, divide the maximum debt limit by your remaining mortgage balance, then multiply that result.

Now, The Loan Limit Is $750,000.

Before the tcja, the mortgage interest deduction limit was on loans up to $1 million.